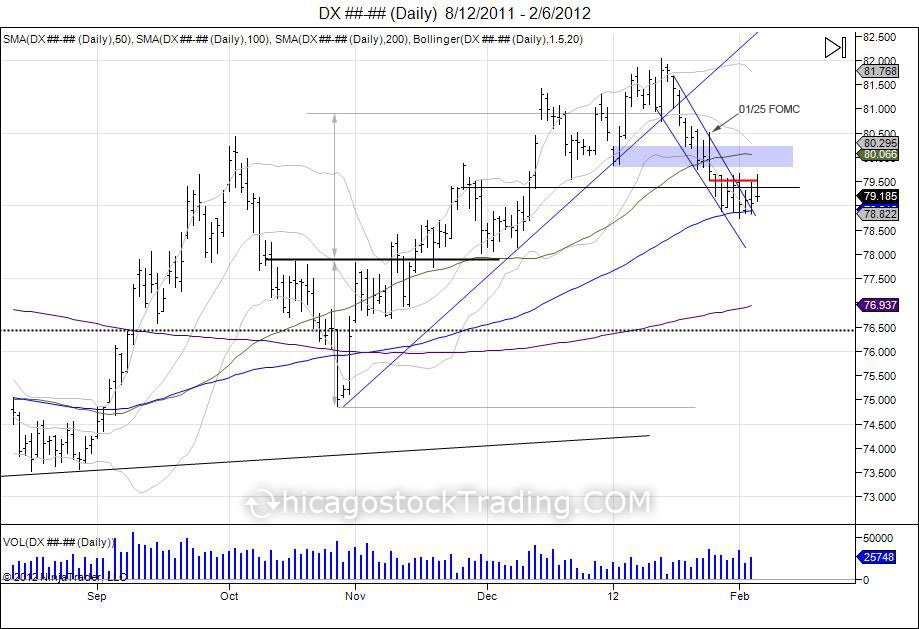

Since the US dollar put in its “Island Bottom” in October of 2010 with the failed breakdown of 74860, the market reversed to create an inverted head and shoulders with a neckline of 77855, targeting 8100. After breaking through its neckline in November, this 77855 level turned into support and the short squeeze was on as the market squeezed into completing its inverted h/s at 8100. Consolidation was seen at these highs with a tug of war taking place. The market began 2012 on Jan 3rd with lows of 79830 and highs of 80225. Following this first day of trading, the market ran into new highs, touching off at 82045 on January 13, 2012. This 8200 level turned into the last hoorah for the short squeeze, trying to get as many shorts out as possible, as the market began to roll over and broke its uptrend line from the October lows on January 18th. Following this break of the uptrend, the market began trading in a newly formed channel pointing down as it targeted the year lows at 79830. These lows for the year were eventually taken out on January 23rd, leading up to the January 25th FOMC statement by the Fed chairman Ben Bernanke. On the 25th as the Fed released their FOMC statement, the US dollar had attempted to rally, however failed. Putting in highs of 80505, only to reverse into lows of 79515. Since this FOMC and break of the year lows, this level has now turned into major resistance for the past 2 weeks at 79515. The year lows that was support at 79830 has also turned into major support as the market reversed its early momentum in the year. At this point the market has reached its 100day moving average on the daily chart and has been in consolidation mode in a fight to hold this support as upside resistance is being tested. Pressure remains to the downside now with the Jan 3rd range of 79830-80225, followed by the FOMC high at 80505 as major resistance. A push past these levels would be needed to get buyers back into control, however only leading to retest the next major resistance coming in at the year highs at 8200 where a failure would create a right shoulder. The question is will the market rally up to test this high and give sellers an opportunity to get out or continue this chase to the downside. Buyers who did not get out in time from last year’s rally are now seeing the pressure turn against them. Below the 100day moving average on the daily, next major support comes in at 77855 being the old neckline from November, followed by the October head at 74860 and year lows of 72860.

more...

Perhaps Mr. Bernanke’s comments in the press conference did not help. Bernanke pretty much stated that if one were to just hold US dollars and “keep them under the mattress” that this was a depreciating asset, and one must invest this in other asset classes to keep up with the "2%" inflation rate. Below is the video along with the transcript.

Fast forward to 10:46:

'I think the argument that the value of your dollar declines at 2% a year is not really a very good one, unless you’re one of those people who does their life time savings in a mattress. Most people invest in various kinds of instruments, receive a rate of interest, now it’s true as you pointed out that for the moment interest rates are pretty low but they are still positive. But over a longer period of time even if you have money in a CD or some other investment vehicle the interest rate will compensate you for inflation. The 2 will be tied together. Levels of inflation this low, interest rates should pretty much fully compensate the losses to savers. But I would reiterate that we are not unaware of the problems that low interest rates cause for savers, cause for pension fund contributions, insurance companies and other parts of the economy and we do try to take that into account as we think about other ramifications of our policy.'

Before Mr. Ben Bernanke became Fed chairman, he made a speech before the national Economists Club in Washington, DC. on November 21, 2002, titled “Deflation: Making Sure "It" Doesn't Happen Here.” In these remarks, there were 5 major points Mr. Bernanke pointed out as tools the Fed could use to fight deflation:

1. Lower interest rates to zero.

First, the Fed should try to preserve a buffer zone for the inflation rate, that is, during normal times it should not try to push inflation down all the way to zero.6 Most central banks seem to understand the need for a buffer zone. For example, central banks with explicit inflation targets almost invariably set their target for inflation above zero, generally between 1 and 3 percent per year. Maintaining an inflation buffer zone reduces the risk that a large, unanticipated drop in aggregate demand will drive the economy far enough into deflationary territory to lower the nominal interest rate to zero.

2. Buy securities from the banks to expand the Feds balance sheets

Second, the Fed should take most seriously-as of course it does-its responsibility to ensure financial stability in the economy. Irving Fisher (1933) was perhaps the first economist to emphasize the potential connections between violent financial crises, which lead to "fire sales" of assets and falling asset prices, with general declines in aggregate demand and the price level. A healthy, well capitalized banking system and smoothly functioning capital markets are an important line of defense against deflationary shocks. The Fed should and does use its regulatory and supervisory powers to ensure that the financial system will remain resilient if financial conditions change rapidly. And at times of extreme threat to financial stability, the Federal Reserve stands ready to use the discount window and other tools to protect the financial system, as it did during the 1987 stock market crash and the September 11, 2001, terrorist attacks.

3. Increase the money supply.

If we do fall into deflation, however, we can take comfort that the logic of the printing press example must assert itself, and sufficient injections of money will ultimately always reverse a deflation.

4. Buy our countries debt.

The Fed was able to achieve these low interest rates despite a level of outstanding government debt (relative to GDP) significantly greater than we have today, as well as inflation rates substantially more variable. At times, in order to enforce these low rates, the Fed had actually to purchase the bulk of outstanding 90-day bills.

5. Devalue the dollar.

Although a policy of intervening to affect the exchange value of the dollar is nowhere on the horizon today, it's worth noting that there have been times when exchange rate policy has been an effective weapon against deflation. A striking example from U.S. history is Franklin Roosevelt's 40 percent devaluation of the dollar against gold in 1933-34, enforced by a program of gold purchases and domestic money creation. The devaluation and the rapid increase in money supply it permitted ended the U.S. deflation remarkably quickly. Indeed, consumer price inflation in the United States, year on year, went from -10.3 percent in 1932 to -5.1 percent in 1933 to 3.4 percent in 1934.17 The economy grew strongly, and by the way, 1934 was one of the best years of the century for the stock market. If nothing else, the episode illustrates that monetary actions can have powerful effects on the economy, even when the nominal interest rate is at or near zero, as was the case at the time of Roosevelt's devaluation.

Source: http://www.federalreserve.gov/boarddocs/speeches/2002/20021121/default.htm

Thus far, since Mr. Bernanke has become chairman, we have seen him implement 4 out of these 5 strategies, lowering interest rates to zero, buying securities from banks, increasing the money supply, and buying the countries debt. The fifth point Mr. Bernanke made was how in 1933 President Franklin Roosevelt devalued the US dollar by 40% against gold. This is the only thing that the chairman has not implemented and since the chairman is a ‘student’ of the depression, and has taken these points as tools he can use to fight deflation and after seeing him implement 4 out of 5 of these “tools”, let us not forget that there is another example he had pointed to that he has not implemented.

Recall this island bottom and short squeeze in the US dollar ETF in October?

And now:

The upside target was completed, now the market is barely hanging on and on the verge of moving back lower to fill this gap from October.