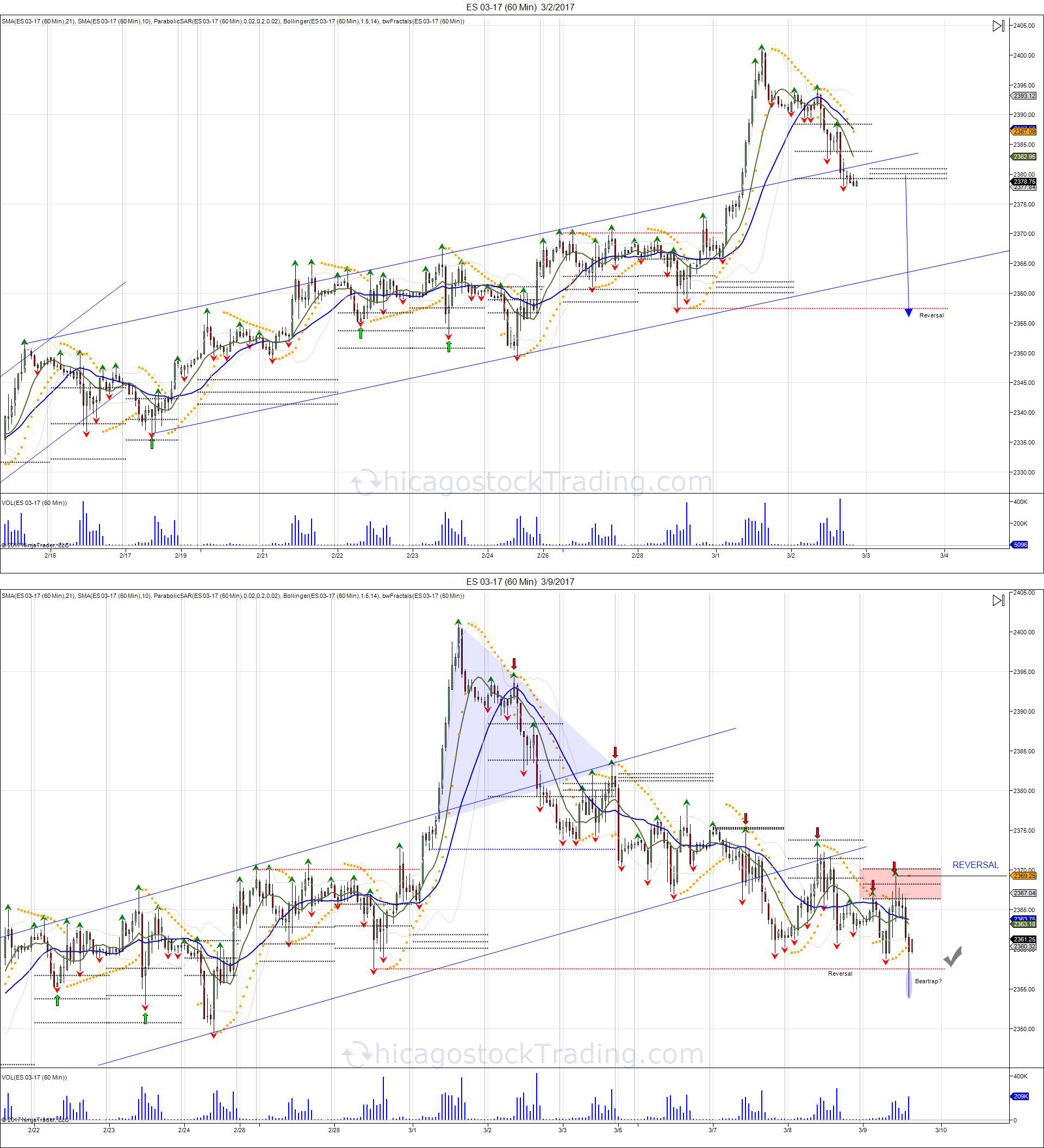

The SP500 took a breather last week. This came after seeing an explosive push on the first day of the month up to 2400, double topping at 2401 before turning lower...

The breather came after seeing the market close below its 3 day pivot on Thursday, March 2nd, reversing the momentum of bouncing off the 3day pivots for the first time since February 1st.

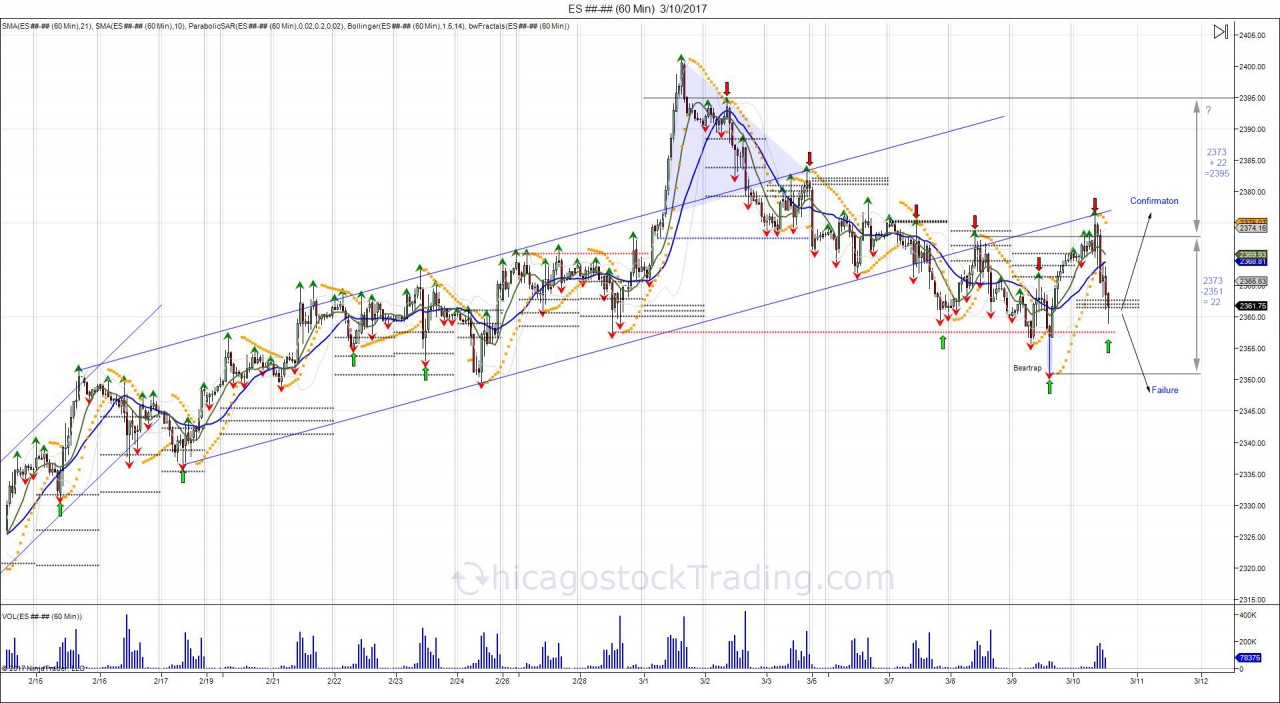

The close below turned the 3 day pivots into resistance until the objective of shaking out longs under the prior Tuesday low of 235750 was seen. On Thursday the market ran stops below 235750, falling into 235100 before snapping higher.

It took 2 days to move from 235750 into 2401, and 5 days to retrace the move... Coiled like a spring, the market snapped back on Thursday:

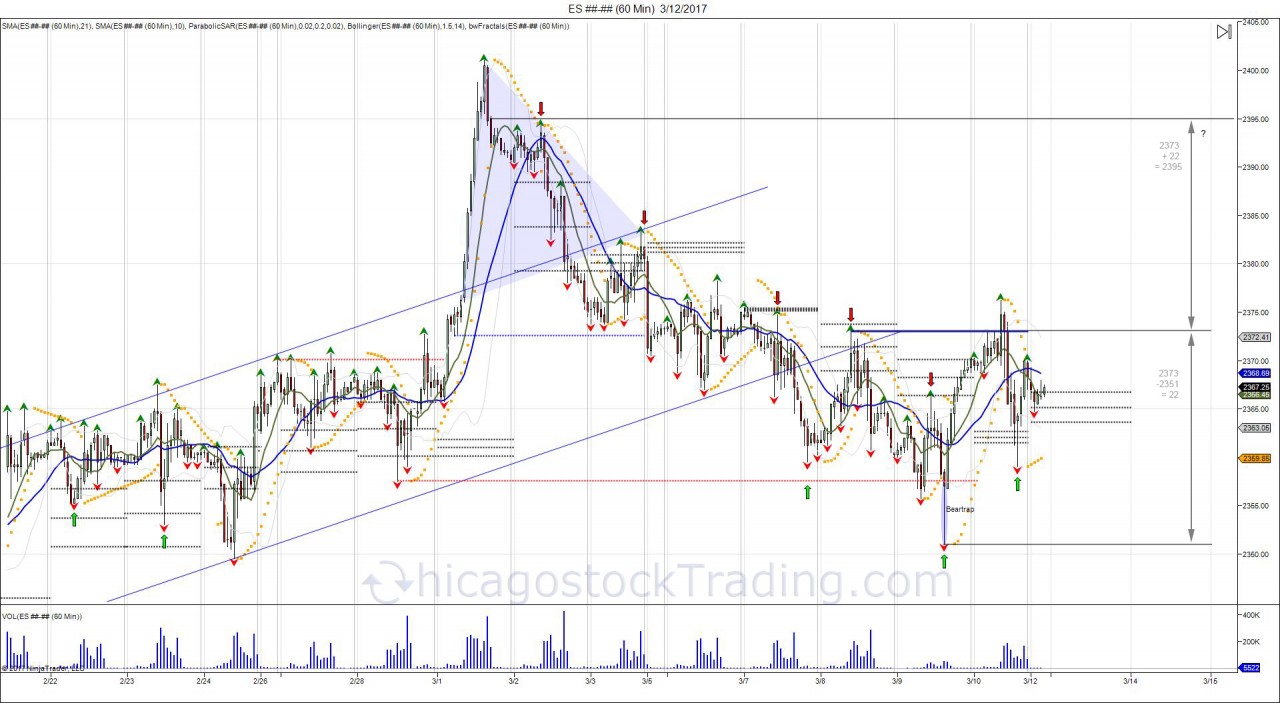

Thursday's snap higher setup a short term reversal for Friday, converting the 3 day pivots back into support for buyers to defend.

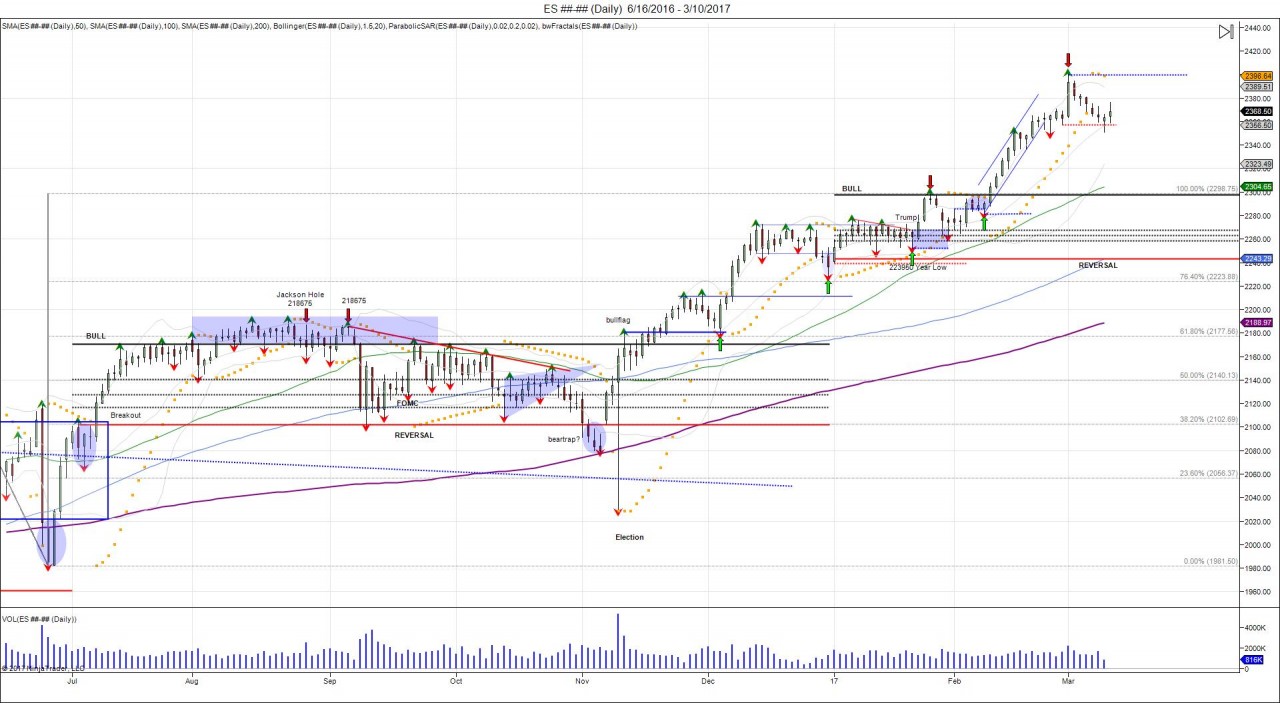

The market bounced off this support on Friday, settling back above Thursday's 236625 high to give bulls a second shot. Monday's 3day pivot range is below the market again within 2363-2367. Buyers have a lot of resistance to work through, as seen on Friday. Pullbacks into Monday's 3day pivot give longs the support to defend to try and work through resistance from Friday's 237625 high. Doing so, confirms the inverted head/shoulder bottom, giving way to expand the 2373-2351 range up to 2395 for a retest of the ATH. Failure to hold 2359 gives another shot at Thursday's 2351 low. Any breach of 2351 rejects the inverted h/s bottom attempt, leaving late buyers from March 1st above 2370 on the hook and giving way to unwind February's squeeze above 2300.

FOMC coming up this Wednesday and after consolidating for a week, buyers are getting another opportunity to retest the ATH. The question for this week's FOMC is will it be a .25, or .50 basis point rate hike?