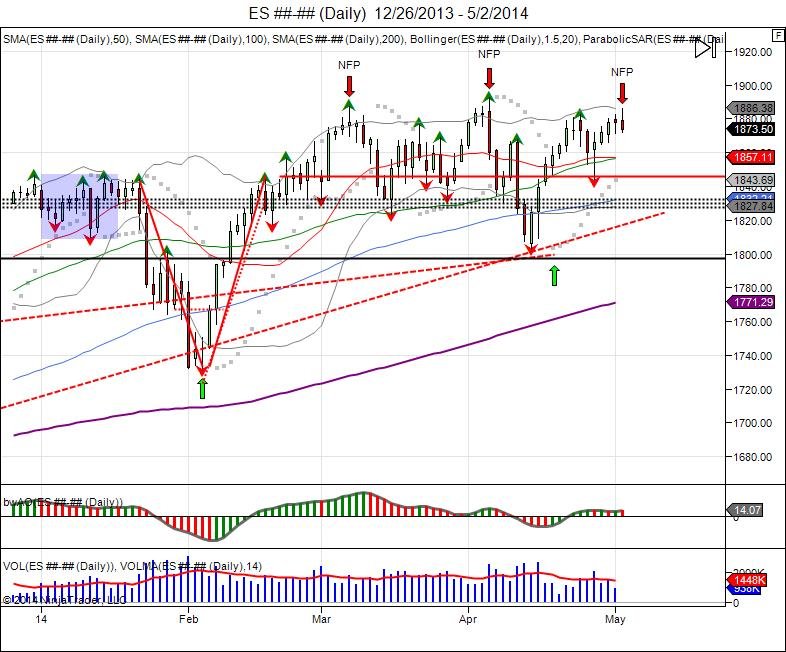

The SP500 for the 3rd time in the last 3 months sold off on NFP numbers. The last two, were both peak highs. March 7th the SP hit highs of 188750 before turning down to 182350. The FRB chair gave the markets a push on the 31st of March reassuring stimulus measures. This gave way for new highs going into the April 4th report at 189250, only to see these highs once again rejected after the NFP numbers were released that morning. This higher high and failure led the market to break March lows and fall down to 1803 in April to shake out the long side and lure in shorts. This has led into a short squeeze leading into today's job number as the market retested the failed April highs to give buy side another chance to push through. Third time was not the charm, as the NFP failed to breach old highs of 189250 and the cash open saw profit taking to hold the NFP high of 1886, setting up a LOWER high, as opposed to the last 2 NFP peaks.

This selling on the Jobs report over the last 3 month period comes as the market nears the old 6.5% unemployment target the FRB established in December of 2012. The SP closed 2012 at 1420, 30 year bonds at 147, gold at 1675, and the Yen at 115. With the unemployment rate now at 6.3% below the 6.5% target that was pulled, we are seeing the 30 year bonds, gold, and the Yen all reverse their trends and show a strong 2014 in contrast to last year. This is putting major pressure against the market as the 3 of these instruments all started on the lows of the year and grinded up to show a reversal and underlying bid by short covering. The consolidation in bonds, gold, and the yen over the last 2 months is the markets way of keeping shorts trapped as the year lows hold and market stabilizes to force them to cover into what is now being seen. The SP500 in contrast, has not changed its 2013 trend as of yet. The year of 2014 started weak with a move down to 1732 only to shake out longs and attract shorts in what turned into a reversal. This setup a V bottom as the 2013 highs were taken out, and clearing the cache of shorts. now it was time to find new buyers to stabilize prices, and this is where we have been the last 3 months, in search of these buyers, which has led the market to consolidate sideways. Throughout this period, all peak highs that attempted to break higher were used as opportunities to take profits into by the market. This shows that the long side is already heavy handed thus finding trouble getting new longs into the boat, giving way for the boat to be tipped for the majority to feel the pain.

1st Peak High- March 7th Non Farm Pay Roll Report: 1887.50

SP500 makes new highs for the year at 188750 before the NYSE cash open. NYSE cash open sees market fail to push past NFP highs and sellers take profits into the NFP rally to settle below the open.

2nd Peak High- April 4th Non Farm Pay Roll Report: 1892.50

SP500 makes new highs for the year at 189250 before the NYSE cash open. NYSE cash open sees market fail to push past NFP highs and sellers take profits into the NFP rally to settle below the open.

AND TODAY:

3rd "No Peak" High- May 2nd Non Farm Pay Roll Report: 1886.00

With buyers having no luck on the last two NFP, today gave a 3rd opportunity to try and see buyers sustain the open. This did not happen as once again the market saw profit taking and settled below its open to disappoint buyers looking for the breakout and have them holding the bag. Difference this time around is that the SP made a lower low from the previous NFP number as opposed to a higher high. This shows a failed retest and lack of buyers. Going into the weekend, headlines of Russia-Ukraine take forefront and this gives potential for a lower Sunday night open. A gap open below Friday's 1872 low leaves buyers from Friday trapped and gives way to retest 1830-1803. Breach of 1803 confirms a failed retest of the April high and a head/shoulder topping pattern to give way to retest the year lows and confirm the V reversal from February was unable to attract new buyers above 1840. Buy side needs to recover Friday's highs of 188600 to squeeze shorts for a run toward the year highs of 189250.

Click to view April 2014 CST Day Trade Performance

RISK DISCLOSURE: PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN TRADING FUTURES AND OPTIONS IS SUBSTANTIAL AND SUCH INVESTING IS NOT SUITABLE FOR ALL INVESTORS. AN INVESTOR COULD LOSE MORE THAN THE INITIAL INVESTMENT.