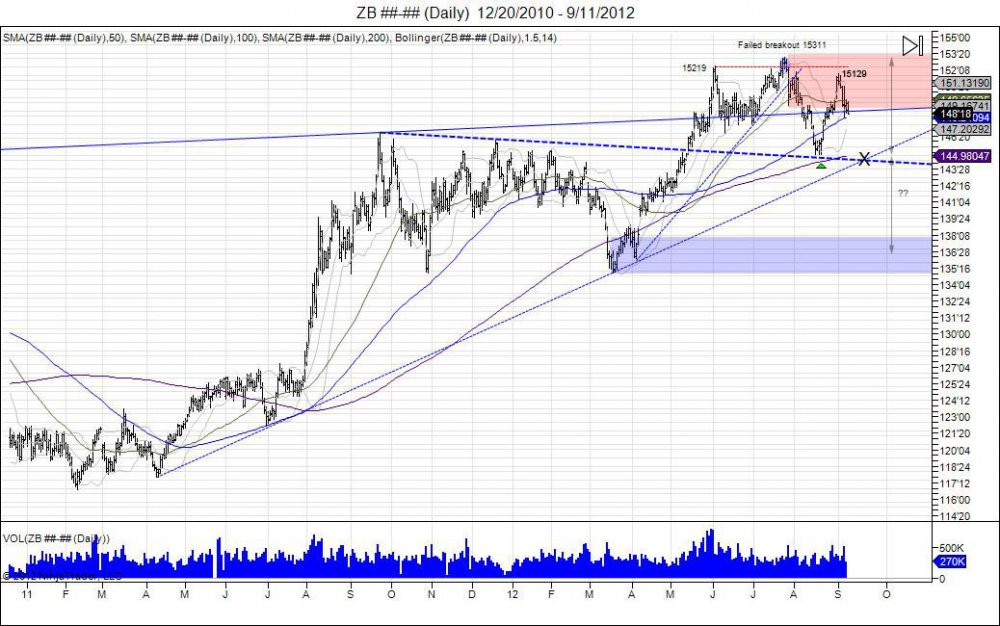

The 30 year bond's consolidation above its resistance line from the 2008-2011 highs has seen the market digest within a range of 14503-15311. The high of 15311 was made in July after an initial high of 15219 in June. This June high saw the market pulldown to retest its resistance line turning into support. This led to the higher high in July squeezing out early shorts as the market ran into 15311. Prices were not able to hold above the old June highs and the move above this level turned into a failed breakout as the market reversed lower in August to take out the June lows and fall down to 14503 which retested where the market broke out in May. Since this low, the market has seen a short covering rally bringing the market back to retest the breakdown off July's highs. The retest has since fallen short with highs of 15129 put in on the first day of trading in September. Since this high the market has backed away and retraced down to 14817 which is now retesting the prior week lows of 14810. This is an attempt to build a right shoulder out of a head/shoulder pattern as the market retested that failed July breakout. Aggressive bears have already faded the move, however the bear needs a close below 14810 this week to see continue the momentum. The target for the move is to retest the August lows of 14503 being the neckline. This brings the market back to where it bounced in August from its old resistance line that turned into support. Should this take place, the bear will have better oppurtunity to take out these lows and fall back below this line since the market saw a squeeze in August to test the July highs in turn building a right shoulder. X marks the spot as seen in the daily chart above. The range of 14503-15311 gives a downside target of 13627. Completing this downside target retests where the market reversed in March within 13805-13505 as then next major downside support. A move past the september highs needs to be seen to trap shorts and target the July high for a short squeeze.

For precise entry, stop, and target levels on day and swing trades along with updates, click here for more information.