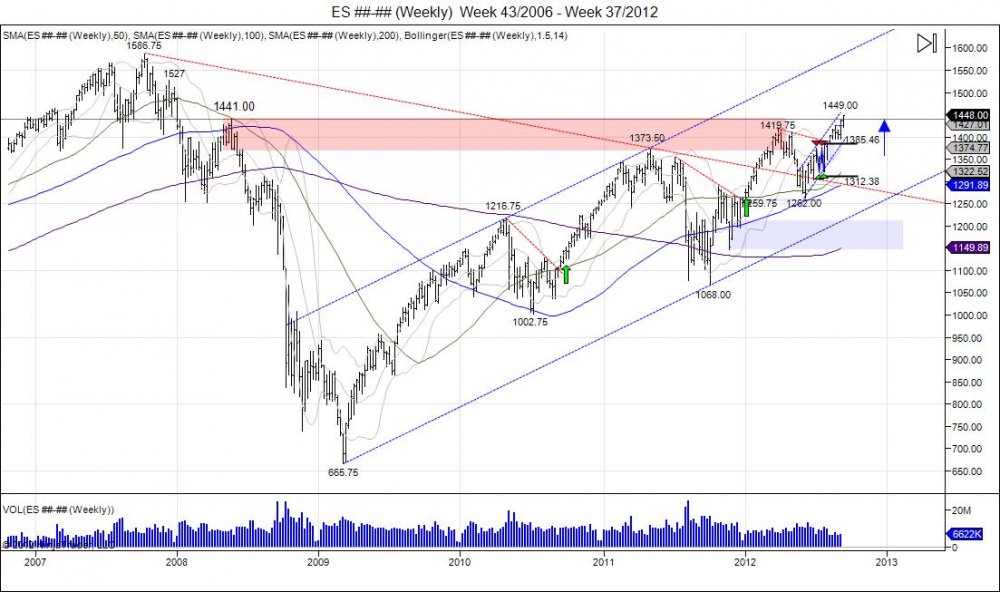

The Emini SP500 front month contract switched to December today, starting the contract 7 points lower then the September contract. Yesterday the September attempted to go after the 1441 level before closing out, only to fall short by .75. Today with the help from the news out of the FOMC, the front month ES (Dec) finally squeezed out that May 2008 high of 1441 and running through 1450s. We have talked about this 1441 level being a target all year since the market started the year with a gap higher and ran after 1400s. After a double bottom in summer at 1262 off the year lows of 1259.75, the market climbed higher to complete this target. The reason why 1441 was so important is this was the high the market reversed from in May of 08 before the crash that came later in the year. So moving past this level further squeezes short sellers and retraces the market to where the breakdown began. If there are any bears left in this market, now is the time to start stalking as all the late comers who missed the move are piling in. At these levels, the market still has room to run higher however we are now neutral equities and allow the market to digest this move and offer the next direction. Bond market is looking lower so there is late money to flow into equities, allowing for longer term equity bulls to lock in profits into. Next major upside levels in the market come in at 1468-1481 off the 1527 December high in 2007. Followed by 1556 off the 1586.75 all time high made in 2007.

Reference

July 12 2012- Will Bullish SP500 Patterns Hold Up? All Point to Year Highs

February 10, 2012- SP500 Video

For precise entry, stop, and target levels on day and swing trades along with updates, click here for more information.