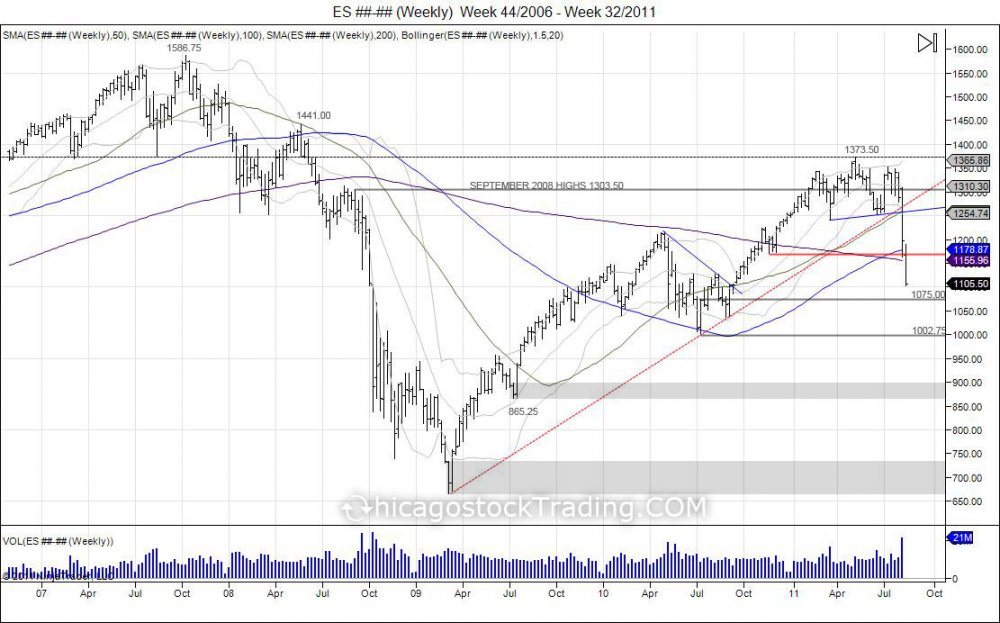

Since the all time highs of 1586.75 set October of 2007, the SP500 corrected into lows of 1255.50 early 2008 with Bear Stearns bankruptcy. A short squeeze was seen up to 1441 in May of 2008, only to reverse and fall into lows of 1373.50. This reversal led to a summer decline that took out the years and set up a shaky market going into the fall. As September began, the SP500 made highs of 1303.50 only to reverse and cause a spike in the Volatility Index. This reversal ultimately led to the crash as the market fell into lows of 665.75, March of 2009. Since this low, the market has channeled higher on glass stairs as it has gone through few major shakedowns however managed to continue the squeeze and retrace 100% of the breakdown from 1441. Below are the corrections seen during this move.

Click charts to maximize.

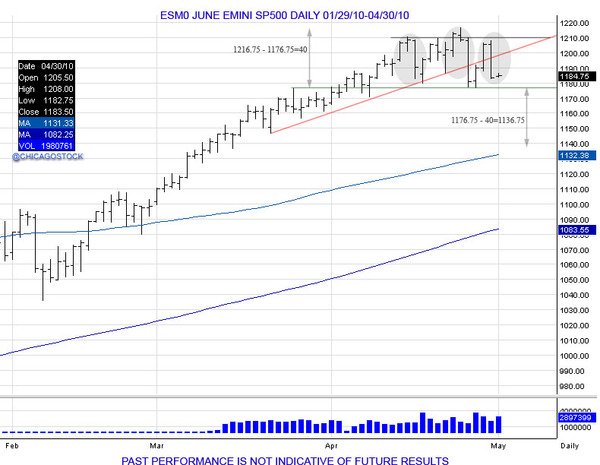

SP500 sets highs of 1216.75 before stalling to create a head/shoulder topping pattern projecting 1136.75. Ultimately seeing a flash crash with a quick move to 1056 before coming back to the 1130 level.

2010 SP500 Head/Shoulder Topping Pattern Completes 1136.75 and sees Flash Crash to 1060s:

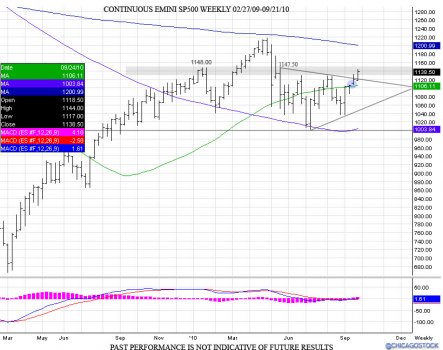

Flash crash led to a volatile period as the market digested the move with lows of 1002.75 before breaking out higher in September of 2010. During this time the Fed continued the language of more quantitative easing to support the market.

Breakout higher leads to a retracement into the May 2008 lows of 1370 with the market setting highs of 1373 in 2011. This is the first time the market traded through its September 2008 levels from where the crash started and digested the move with a range of 1270-1370. This consolidation of the return to September of 2008 leads to another correrction.

2011 SP500 Head/Shoulder Topping Pattern Against 1373, Projecting 1100:

2011 SP500 Head/Shoulder Topping Pattern Completes Projection Down to 1100 on "US Debt Downgrade"

Similar consolidation of 2010 breakdown is seen in 2011 breakdown. More stimulus promises and a breakaway gap to start 2012 as the breakaway gap in September 2010.

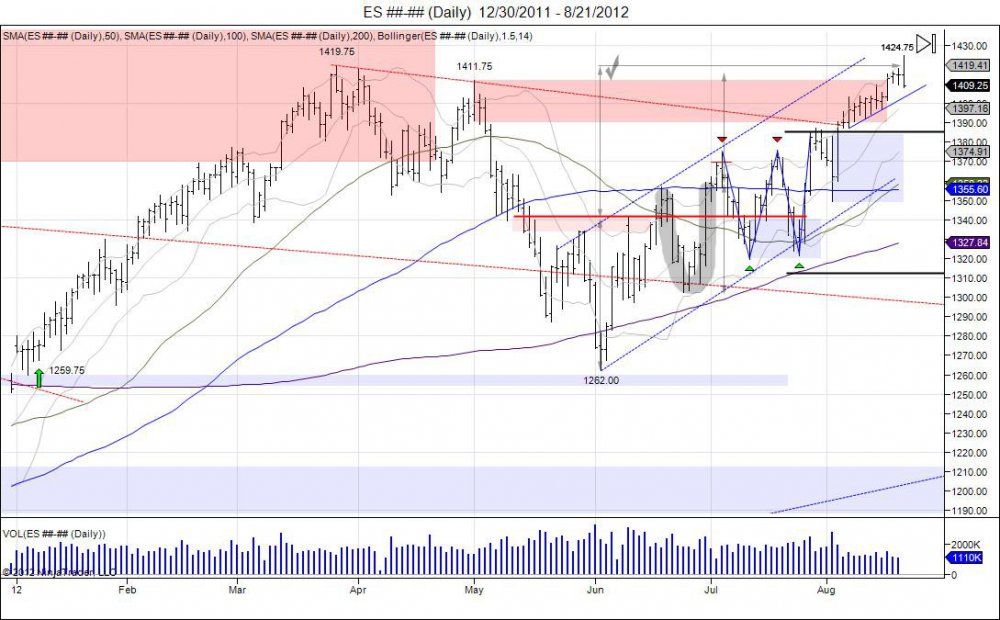

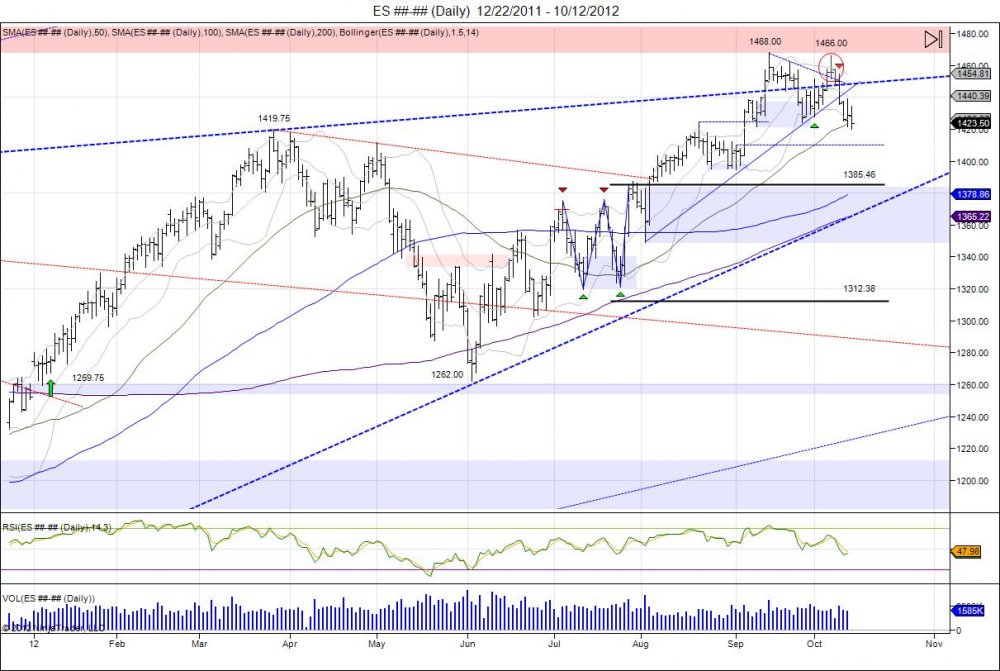

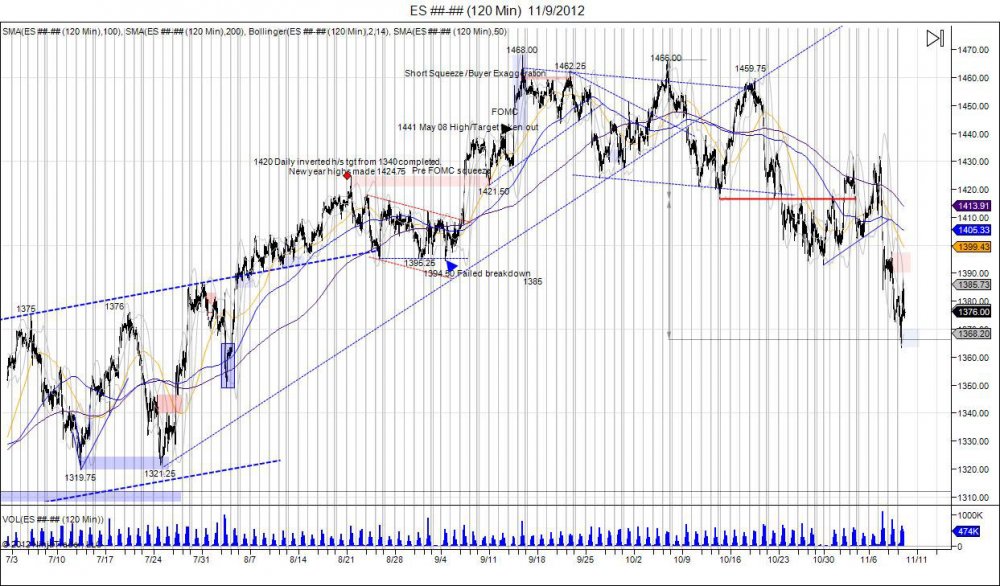

SP500 2012 breakout led to 1419.75 before seeing the last level of 1441 defense see a small correction to retest the year lows of 1259.75 and fight to hold gap from 1252.50 open.

2012 SP500 Inverted Head/Shoulder Bottoming Pattern Against 1259.75 Year Low, Projecting retest 1420s:

SP500 2012 Inverted Head/Shoulder Bottoming Patern Completes Projection of 1420s:

SP500 completes 100% retracement of 1441 on boast from Fed to go all in on more Quantitative Easing. This final QE did enough to retrace the 1441 level in the ultimate short squeeze from 665.75. Just as this is done, the news of more QE creates such a bullish environment, even sellers have turned into buyers. This creates another period of consoldiation and a double top against the 1468.00 highs.

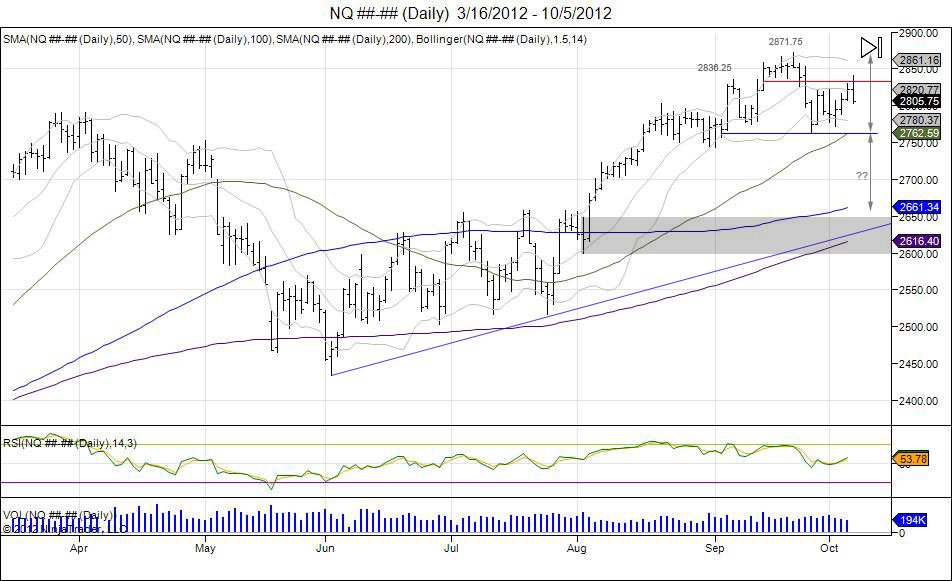

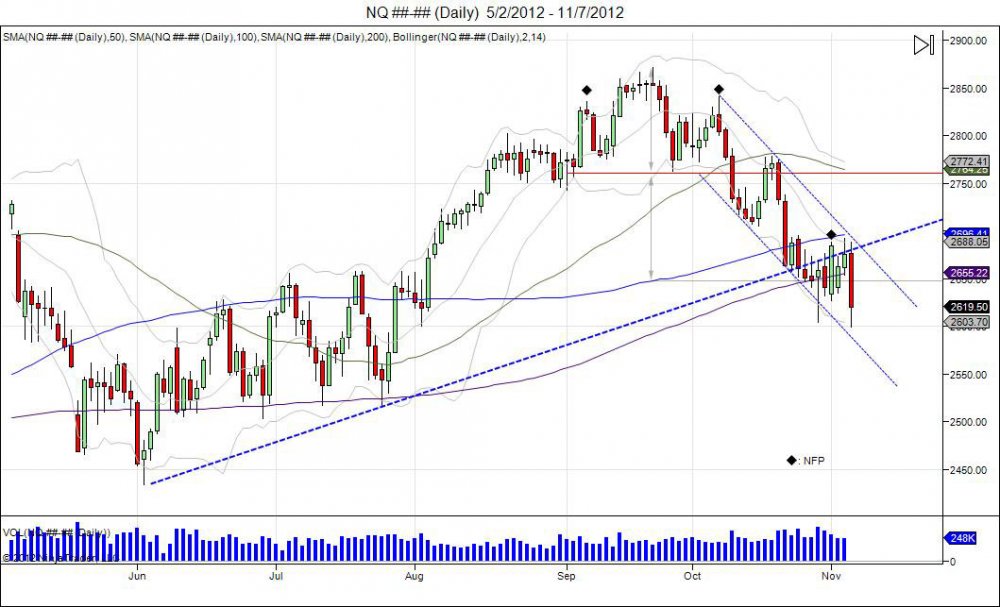

SP500 double top sees a head/shoulder pattern develop in the Nasdaq. Right shoulder is established on the better then expected Non farm payrolls reported October 5th.

2012 Nasdaq Head/Shoulder Topping Pattern Against Major 2900 Resistance from Dot Com Era, Projecting 2650s:

2012 Nasdaq Head/Shoulder Topping Pattern Completes Projection into 2650s:

SP500 2012 Head/Shoulder Topping Pattern After Digesting 1441 Completion. Projecting 1365s:

SP500 Head/Shoulder Projection Completes 1365s:

Going forward we have seen the short squeeze in the SP500 complete from 665.75 to 1441.00 with bumps along the road. The last round of quantitative easing led to the final squeeze. This has failed to hold and the market has come back to retest where it broke out in August this year. A strong market will consolidate this move and see buyers step in to defend the pullback. However since 1441 is done, the pressure for the move is to refill the gap down to 1252.50 that began the spark higher.

If you have trouble viewing charts, click to enlarge or view using Internet Explorer.

RISK DISCLOSURE: PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN TRADING FUTURES AND OPTIONS IS SUBSTANTIAL AND SUCH INVESTING IS NOT SUITABLE FOR ALL INVESTORS. AN INVESTOR COULD LOSE MORE THAN THE INITIAL INVESTMENT.