click chart to maximize

more...

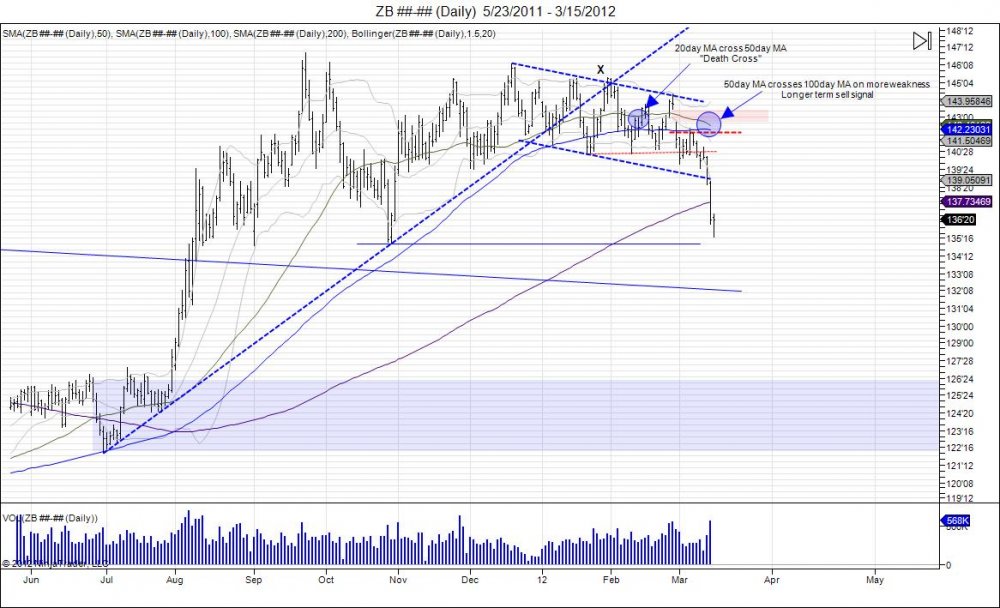

The 30 year bond fell into lows of 135'18, completing its downside move into the 135 handle as the retail chase came in following the markets break of the year lows at 140'21 and December lows of 139'24. This all started after the market squeezed out weak shorts late February, in turn a headfake into the June contract roll. Once the June became front month this showed a gap on the continuous chart and began a chase as sellers got caught on sidelines and longs off guard. The gap was never filled and turned into resistance, leaving market to be caught off guard and sellers to chase as buyers got taken to the woodshed. Over the past few months we have warned about the complacency of the bond market bulls and how the market was slowly slaughtering them as it tried to break out many times but cotninued to fail. It is hard to knock down a 300lb gorilla and a strong trend, but it takes a few punches, and with a gap, this was the punch needed to drop the bull. The market has now sliced through the 200day moving average squeezing out a good majority of longs, however is now finding support as smart money who caught the move is covering shorts as the market now tests major support from September lows at 13501. This comes just as the 50/100day moving average look to cross to trigger a longer term sell signal. We have already seen the market retrace 23.6% of its breakdown from 14105-13518 at 13627. The market will attempt to squeeze out shorts chasing this move and or make it hard to continue the move down as this 13501 level will take a bit of work to break. Major upside resistance now comes in at the old December lows of 13924 followed by 14002. Breaking below 13501 confirms the bust of the bond bubble and gives room into the July highs at 127 which is where the short squeze into 147 began. This is big damage to the bond market, and a move through 14414 is needed for the bull to regain its control, which is a long way away.

click chart to maximize

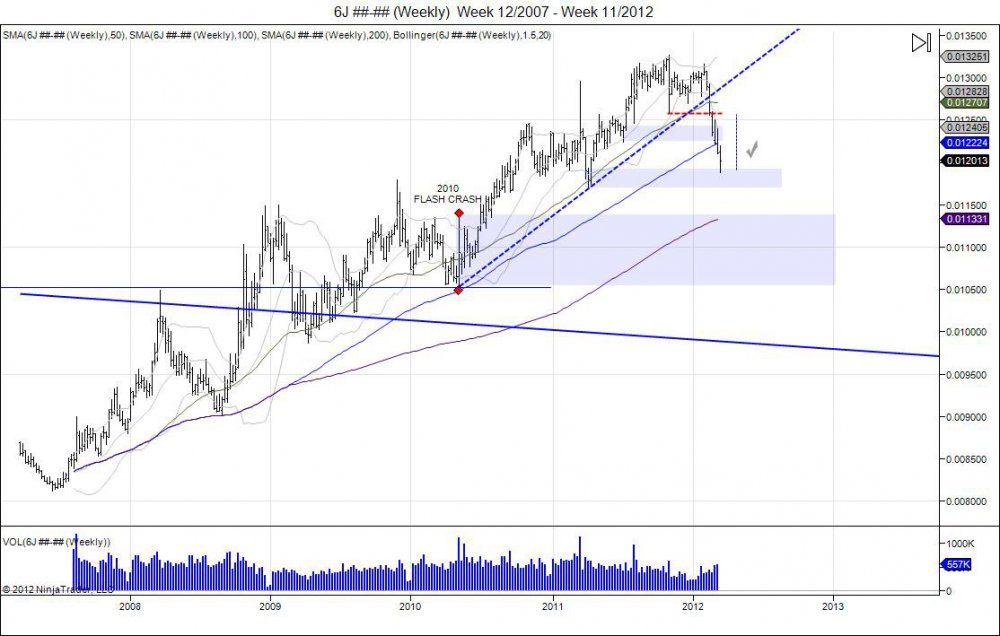

Notice what the Japenese Yen and the 30 Year Bond charts have in common. Both had flat tops for 6 months, and crashed. Yen began the move first: http://bit.ly/wB63eA The Yen completed its target down into 119 just as the bond market completes its first move down into 135. Just as bond market tests major support, Yen also tests major support at 117-119. A break below this targets the July breakout in the Yen, just as the Bond market needs a break below 135. This retraces them into the next major levels, being the the highs of 11375 for the Yen during the "flash crash" where it broke out, and 127 in the 30 year or a yield of 4.1%.

click chart to maximize

click chart to maximize

3_15_2012_1.jpg)