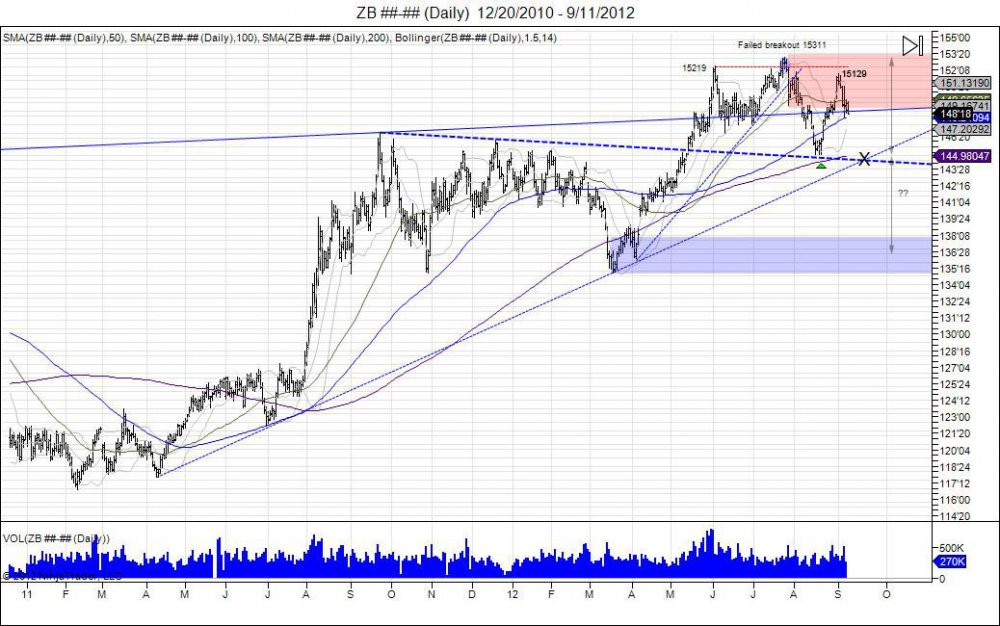

After putting in a lower low by a tick overnight down to 14415, the 30 year bond covered shorts as buyers came in to defend this neckline currently in jeopardy. This neckline is in jeopardy due to the failed retest of the 15311 high as the market ran to 15129 and turned lower in turn building a right shoulder. The currently action being seen now is an attempt to flag off this neckline support of 14416 to retrace into testing where the market failed. First level comes in at the FOMC lows of 14605, thereafter 14810-15129 being the range of the right shoulder. Retracements into this offer sellers a level to defend as a break through 15129 is needed to squeeze the bear and target the 15311 highs to void out this head/shoulder topping pattern.

As the 30 year has fallen into a major line in the sand, the Emini SP500 has also crossed through its major level of 1441 and topped at 1468. This 1468 level was tapped to the tee and kept a lid on prices in the short term as the market pierced the top of its daily channel since the 1262 lows made in June. Currently pullback is being seen to test Friday's lows of 1449.50 as support for buyers to defend and retest the highs above 1460. Next major resistance comes in at 1481 based off the December 2007 high of 1527. Downside support is seen within1438-1421, 1410-1395, and 1383-1349.