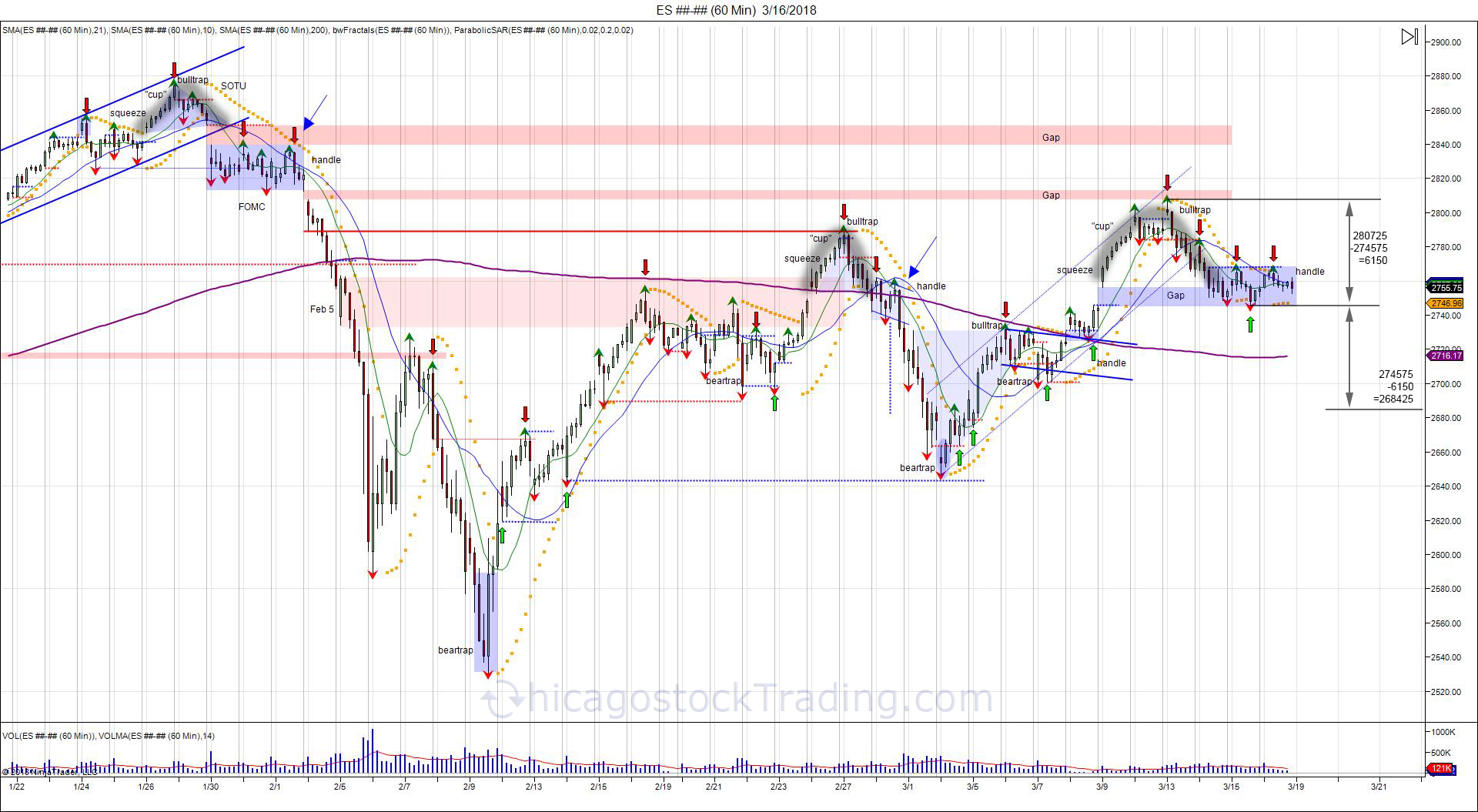

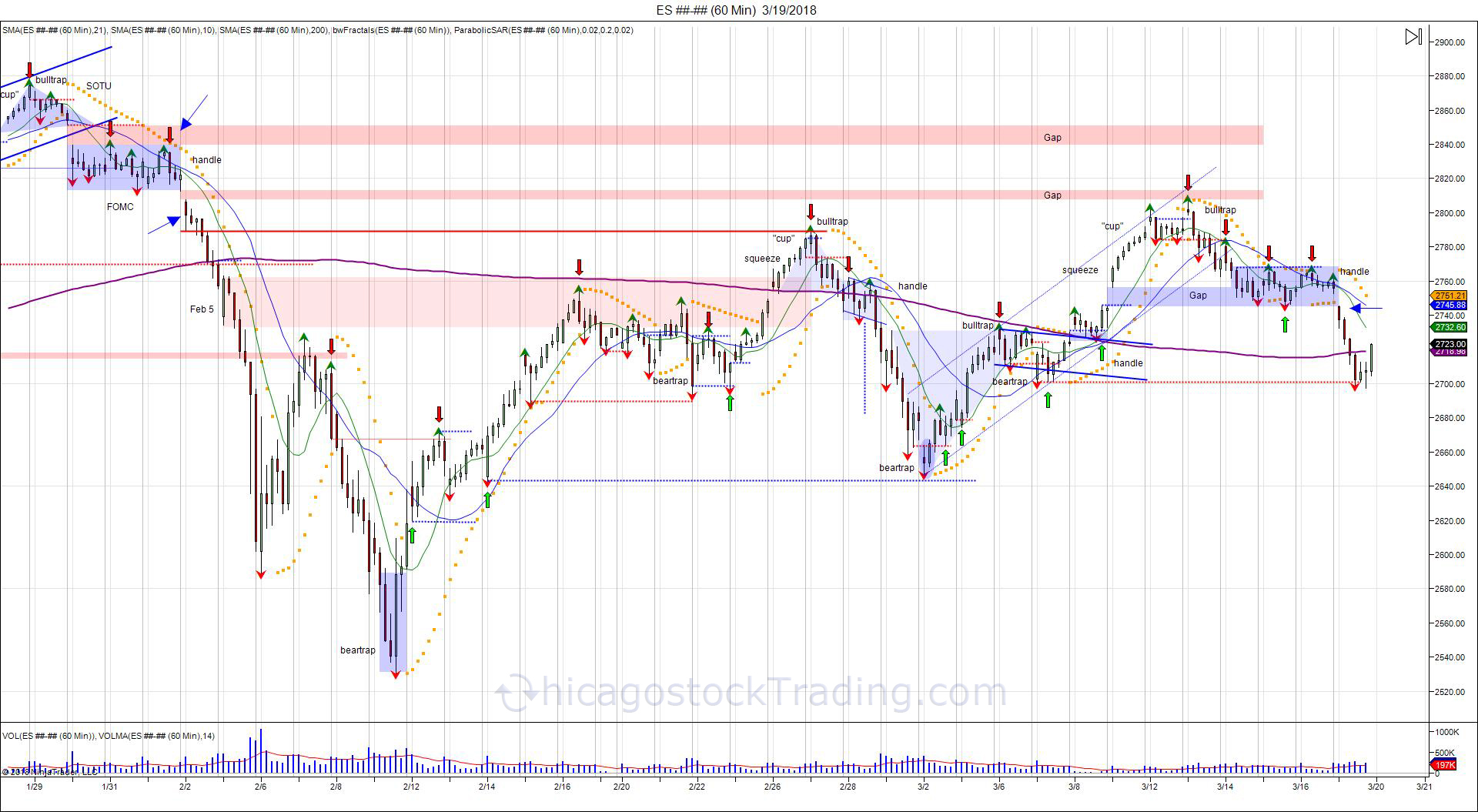

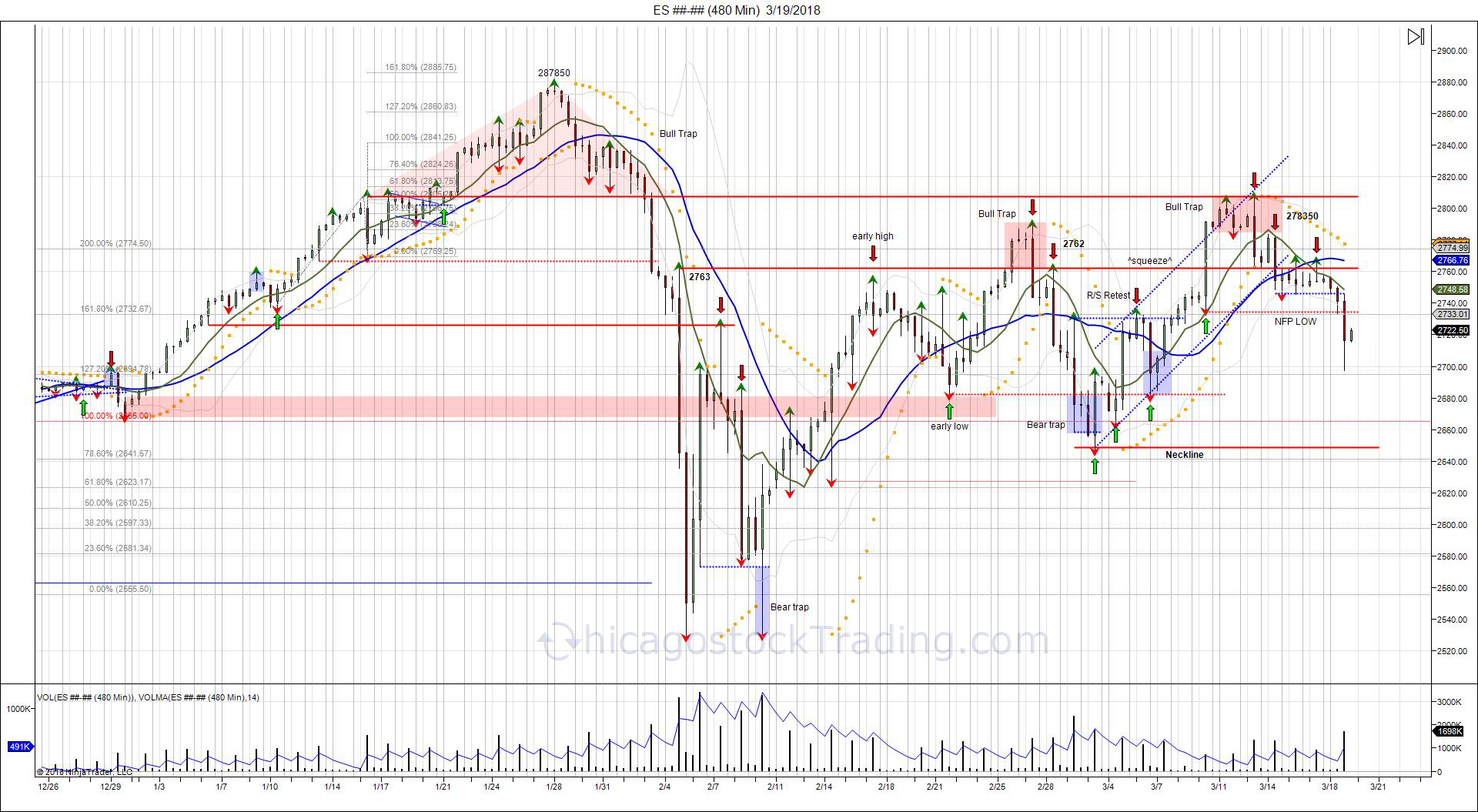

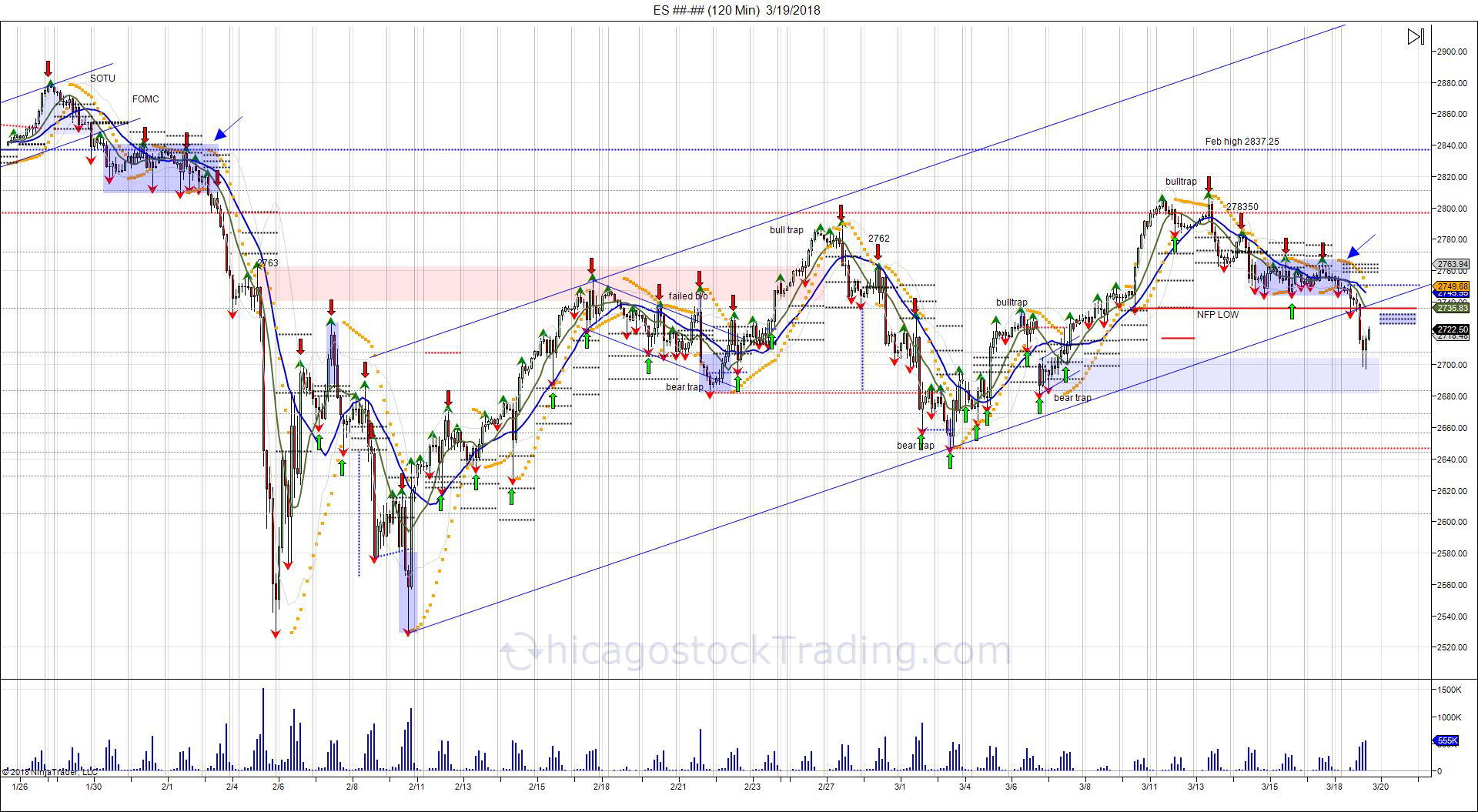

When Cohn resigned, the SP traded to a low of 2681 before turning up to close at 2723. The following day, March 8th, the cash market opened above 2730, leaving shorts from Wednesday trapped as the market settled at 2744. The following day on NFP Friday, the cash market opened at 2759.75, forcing shorts to cover as the market used trapped shorts to fuel a move through the prior high of 2789. After taking out shorts above 2790, new buyers were lured in on the breakout, this breakout ran into testing major resistance from the February 1st gap of 2822. By failing to overcome the level, the market showed more supply still trapped above, converting the level into resistance as the market fell back to 2745 to retest the NFP low of 2735. Over the last 3 trading days, the market fought to hold 2745, however was unable to overcome 2768, leaving buyers from last week on the hook. This also gave the opportunity to repeat the pattern seen on Jan 30 - Feb 1, creating an inverted cup/handle pattern.

Today, in repeat of February 2nd when the market fell 51 handles from 2806 to 2755, the market again opened below its "handle" at 2745, falling 48 handles to a low of 2697. By opening below last week's low, buyers from last week were left on the hook and sellers who got squeezed on the move from 2730-2790, were forced to come back and chase the market lower. The break to the downside saw the market take out the cash low from March 7th at 2700.25, when the bear trap was set and Cohn resigned as NEC. This retracement into 2700, saw the market consolidate and squeeze into the close back at 2723. Going forward, opening above 2723 gives bulls another opportunity to overcome Monday's failed high of 2745. Doing so, would trap sellers that piled in on Monday's break below 2720, giving fuel for bulls to try and retest last week's failed 2807 high with resistance at 2797. Cash open below 2704 on the other hand, keeps sellers in control in attempt to expand the inverted Cup/Handle target down to 2680, which takes out the Globex low of 2681 from March 7th "Cohn" news.

In the above chart you can see the squeeze over 2762 on March 9th taking out shorts above the prior high of 2789 and into testing major resistance at 2807, based on the bull trap set above in January. With the market falling back to 2762 last week and failing to overcome 2783 on Wednesday, this left breakout buyers from last week on the hook. By losing 2762, they were forced to defend the NFP low of 2735 by holding 2745. This created a tug of war between 2745-2762 as buyers fought to hold. By losing the NFP low of 273550 today, it shows the move up was not real demand, but rather shorts just being cleaned out and with the market back down, there are no buyers able to hold it from breaking. Thus keeping in line with the theory that there is more supply trapped above then demand. This goes with the story of the year, seeing shorts being squeezed, new buyers piling in, buyers failing to expand on the breakout as sellers come in to fade the short squeeze and return the market back to where it broke out. Today, the market fell to test the "Cohn" lows, with the cash low being 2700.25 and Globex low of 2681 on March 6th. Thus far retest of 2700 has caught a bounce back, in which the failed NFP level will be key for buyers to overcome to show whether supply above creates a lid, or new demand can step up to recover. Rallies back to 2735 provides resistance for sellers to defend and buyers to overcome. Through Monday's 2745 high, gives opportunity for buyers to overcome the trap above 2762, to get another shot at the failed 2807 high. Failure to overcome 2735-2745, leaves buyers on the hook and sellers in control to attempt the next leg down to test the Globex low from March 6th at 2681.

Chop seen last few days, matched the chop seen Jan 30th - Feb 1st, before seeing the gap lower on February 2nd that expanded the market lower. Having the 3 day pivots above the market kept a lid on prices last week and with the third shot at 2745, the level failed to hold, leading to sell stops under 2735 in being taken out, reversing the squeeze seen a week and a half ago on NFP. Pullback fallen into testing the bear trap from the "Cohn" news, being a major area of support for buyers to defend and sellers to get through. Rallies back to 2735 will be key for sellers to defend and buyers to overcome. Closing above Tuesday's 3day pivot range can leave shorts trapped with stops over 2750 to squeeze shorts in attempt to snap back to 2797. Failure to overcome Tuesday's 3day pivots keeps sellers in control and the momentum negative, for sellers to try and take out 2700-2680.