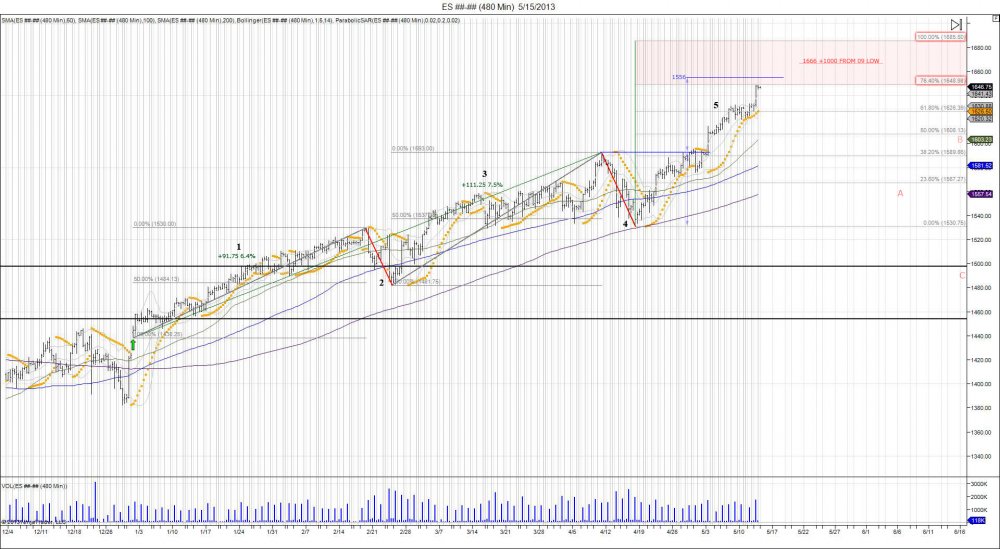

The latest breakout above the previous high of 1593 is extending to be the 5th wave of the 2013 breakout above 1440. As seen in the charts, the market has had 5 waves this year. The first wave starting from the year lows of 1438.25 to the February high of 1530 rising 6.4%. The corrective wave off these highs retraced 52.6% to 1481.75 before stabilizing. The breakout above the previous high of 1530 began the third wave up as the market rose 7.5% into 1593 in April before correcting. The corrective wave off these highs retraced 56% to 1530.75 before once again stabilizing. The latest squeeze through 1593 has become the new wave up, being the 5th wave of the bullish trend. The 5th wave is usually the strongest out of the 1,3 ,5 buy waves as it attempts the final squeeze and extension of the trend, luring in the late buyers. This happens as the market never pulled back to retest the April lows allowing for buyers to defend 1550s, and forcing a chase above 1600. The chase thus far has been strong, with the market extending 76.4% above 1593 at 1648.75, and up 7.7% from the 1530.75 low, already a larger % move then the 1st and 3rd buy waves. Major resistance is being met at these levels. The range of 1593-1530.75 (62.25) completes at 1655.25 to be a +8.1% (1593+62.25). Next level comes in at 1666 to mark 1k points off the lows and 8.8% move from 1530.75, followed by 1685.50 as the 100% fib extension and 10.1% off the 1530.75 low. As this latest wave pushes higher, bulls are most present and bears are ridiculed. Major upside targets are being thrown out, pumping the market. As per the Elliot wave, once the 5th wave completes by seeing a correction off the highs, an a,b,c corrective pattern can be attempted. This can turn into a consolidation to build a base or a head/shoulder pattern as A is the wave off the high, B the wave to retest the high, and C the wave that fails the retest and falls to take out previous low from A which is needed to confirm change in trend.

Wave 1: 1438.25-1530.00 +91.75 6.4%

Wave 2: 1530.00-1481.75 -48.25 3.1%

Wave 3: 1481.75-1593.00 +111.25 7.5%

Wave 4: 1593.00-1530.75 -62.25 3.9%

Wave 5: 1530.75- *1685.75* +155 10.1%

Wave 5 ends when market turns back to take out the pivot low of 153075 that began the chase through 1593.

Sell stops are loaded up on the downside as the market built bases into the upside squeezes. These come in below 1620, 1607, 157075, 152950.

RISK DISCLOSURE: PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. THE RISK OF LOSS IN TRADING FUTURES AND OPTIONS IS SUBSTANTIAL AND SUCH INVESTING IS NOT SUITABLE FOR ALL INVESTORS. AN INVESTOR COULD LOSE MORE THAN THE INITIAL INVESTMENT.