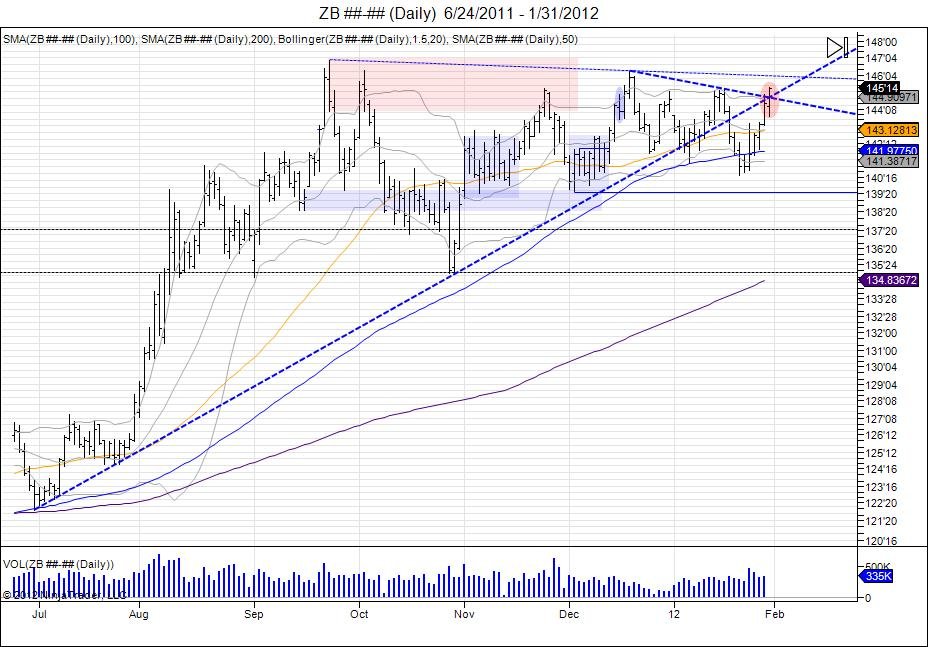

'X' marks the spot in the 30 year bond market as it squeezed through where two major trendlines crossed. The first major trendline being the June-October lows and the trendline from December - January highs.

more...

The bond market squeezed through where these trendlines met "X", looking to squeeze out shorts, as it clipped the January 18 high of 145'13 by two ticks to 145'15. There was not much of a thrust above this level as stops were triggered indicating the potential that big sellers were sitting defending these highs. The market did make a U turn, from 14513 to 14021 late January, and back to the highs at 14515. This "U" turn, also called a CUP formation is the market coming back to where it broke down from. This is after those 143'13 highs in January failed and the market reversed to put in new lows for the year, followed by this new reversal coming back to where it broke down from. At this point its up to whether there will be continued demand at these levels to continue the momentum and target the December highs of 146'11. Buyers like to see a consolidation here looking for a base in turn building a "Handle" for this "Cup" to build energy for the next leg up. On the other hand sellers must look to defend these highs and take out the lows of 14328 to gain traction to the downside and turn this into a false breakout, targeting the December lows of 139'24, followed by 133'00.